Although there is no universally accepted definition of climate finance, there are examples of operational definitions, including this one from the

Standing Committee on Finance (SCF) of the United Nations Framework Convention on Climate Change (UNFCCC):

"Climate finance aims at reducing emissions, and enhancing sinks of greenhouse gases and aims at reducing vulnerability of, and maintaining and increasing the resilience of, human and ecological systems to negative climate change impacts"

(SCF, 2014).

The

Organization for Economic Co-operation and Development (OECD), in turn, defines climate finance as: "the capital flows seeking low-carbon and climate resilient development, which can be public or private, through concessions and non-concessions" (OECD, 2015).

Both the

SCF and the OECD have calculated the flows of global climate finance. The

SCF estimates that these flows were around USD687 billion in 2013 and USD741 billion in 2014. The

OECD and the Climate Policy Initiative (CPI), in turn, estimate that USD62 billion dollars were provided as climate finance in 2014, up from USD52 billion in 2013 (OCDE, CPI, 2015). The difference between these estimates highlight the question of how to accurately account for climate finance, and the need for clearer methodologies.

The Subsidiary Body for Scientific and Technological Advice of the UNFCCC is currently undertaking a process to improve accounting rules for climate finance with the aim of enabling countries to adopt unified guidelines in 2018.

Climate finance in the international context

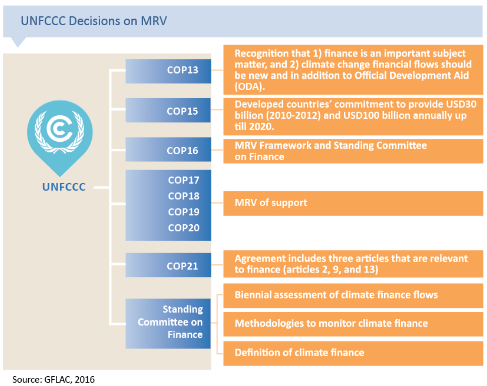

The

UNFCCC was created in 1992 as a mean to achieve the stabilization of emissions of greenhouse gasses (GHG) and reduce the vulnerability to the adverse impacts of climate change. Climate finance is one of the most important pillars of the international negotiations.

At the 15th Conference of the Parties (COP 15) to the UNFCCC (Copenhagen, 2009), the countries agreed to transfer USD30 billion between 2010 and 2012 from developed to developing countries, and USD100 billion annually by 2020. There is debate among countries as to whether the initial USD30 billion was met, with some developing countries noting that this funding may not have been new and additional (as required). The debate further highlights the urgency of greater transparency in the accounting of climate finance.

The

Paris Agreement (COP 21 in 2015) included several mandates related to transparency and monitoring of climate finance. For example, Article 2 calls for "making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development." This mandate implies the need for a baseline understanding of current financial flows, and a roadmap for achieving this goal. The Paris Agreement also calls for developed countries to report every two years on the quantitative and qualitative support provided and mobilized to developing countries (Article 9). In recognition of the fact that developing countries also contribute to international climate finance, the Agreement encourages these countries to provide information on finance they have provided to other countries on a voluntary basis. The Agreement also calls for an enhanced transparency framework to support mutual trust between developed and developing countries (article 13).

The new

Sustainable Development Goals (SDG), created in 2015, constitute another valuable tool for the definition of indicators of support provided and received, as they incorporate climate change as goal number 13.

In summary, these decisions and initiatives reflect the need to increase transparency and to build trust between the parties. They affect developing countries like Colombia, which in addition to being the fourth largest recipient of climate finance in the region (ODI, 2015), is also a provider of financial support, as seen in its commitment of USD6 million to the Green Climate Fund

in 2014. Creating a Climate Finance MRV System will help increase understanding of the needs, voluntary commitments, and funding opportunities for the country.

Climate finance in the national context

In Colombia, several institutional arrangements support a climate change agenda that was set up by the

2014-2018 National Development Plan. The National Climate Change System, known as SISCLIMA, is one example of such an institutional arrangement (Decree 298 of 2016). The Ministry of Environment and Sustainable Development (MADS) is leading the construction of a National Policy on Climate Change to incorporate climate change management in public and private decisions, with a view of moving the country towards low-carbon, climate-resilient development.

The country has several national strategies, plans, and programs to address climate change, including:

Colombia's Low Carbon Development Strategy

National Plan for Adaptation to Climate Change

Strategy for the Reduction of Greenhouse Gasses Caused by Deforestation and Degradation of Forests and for the Protection and Enhancement of Carbon Sinks (REDD+)

Strategy for Public Policy Financial Management to deal with the Risk of Disasters caused by natural phenomena

National Strategy for Climate Finance

The

Financial Management Committee of SISCLIMA is Colombia's first inter-agency coordination mechanism and public-private dialogue focused on climate finance. The Committee created the National Strategy for Climate Finance, for which it conducted measurements of climate finance, including one by

Econometría and

Alianza Clima y Desarrollo - CDKN

on public spending in Colombia.

In 2015, the Institute of Hydrology, Meteorology and Environmental Studies (IDEAM) developed the

Biennial Assessments (BA), which fed into the Country's Third National Communication to the UNFCCC (in preparation as of March, 2017) and contained information on climate finance. This entity also delivered national communications in 2001 and 2010.

To achieve more thorough results in the measurement of climate finance than had been obtained in previous assessments, the DNP, in collaboration with the

World Resources Institute (WRI) and the

Latin America and the Caribbean Climate Finance Group (GFLAC), developed a methodology to classify and measure financial resources associated with climate change mitigation and adaptation in Colombia. The methodology was developed with the input of several other government entities.

This methodology has now been used by several other entities, including the United Nations Development Program in its Climate Public Expenditure and Institutional Review, and Econometría and GFLAC in their analysis of international financial flows. The latter analysis was conducted with support from the

French Cooperation Agency through the "Fondo Acción." The results of both exercises are part of the databases that feed the MRV system. The methodology will also be used to make future estimations of climate finance for the system.