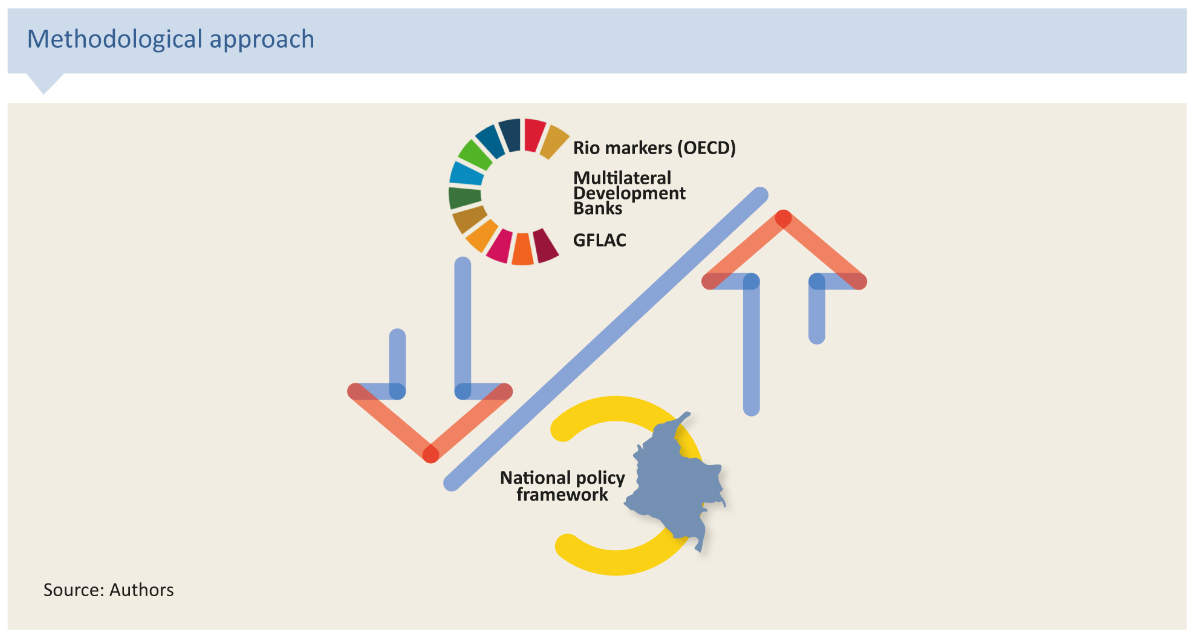

The Climate Finance MRV System uses a common methodology to estimate climate finance in Colombia, which increases the quality of the information and allows for data comparison over time. The estimates are then uploaded to the platform of the system.

This section briefly explains each of the aspects of the methodology. The full content of the methodology is in the document "Methodological Guide to Measure and Classify Financial Resources Associated with Climate Change Mitigation and Adaptation in Colombia," which is available

here.

General scope

The objective is to provide a methodological approach that can lead the measurement, classification, and analysis of funding associated with climate change mitigation and adaptation in Colombia coming from public and private, national and international sources.

Principles

The Methodological Guide is based on the following principles: flexibility, transparency, comparability, and consistency.

Flexibility: the methodology can be tailored to the needs and capacities of various actors who wish to measure and classify climate finance. A flexible methodology can more effectively help obtain sound data that informs decisions taken in the country and in the world in the field of climate change.

Transparency: The methodology seeks to improve access to information; increase the transparency related to financial flows associated with climate change; and to improve decision-making and the use of these resources.

Comparability: The methodology seeks to generate data that can be comparable over time.

Consistency: The methodology seeks to facilitate uniformity in the estimation of financial flows associated with climate change.

Sectors

In the studies of the Intergovernmental Panel on Climate Change (IPCC), climate change is recognized as a multi-sectoral problem, where GHG emissions come from almost all sectors of the economy. The methodology then explores sectors included in several international methodologies for measuring climate finance (e.g. the OECD-DAC's Climate Markers also known as the Rio Markers), as well as relevant national databases that use sectoral classifications established by the Colombian government. These databases include the Integrated Financial Information System (SIIF), the Single Territorial Form (FUT), royalties' income, and other sources of financial information. The methodology also considers the sectoral classification used in the inventory of greenhouse gasses of the Institute of Hydrology, Meteorology and Environmental Studies (IDEAM).

The methodology identifies 12 sectors that are relevant to climate change mitigation and adaptation actions, 35 sub-sectors, and a total of 248 actions associated with climate change mitigation and adaptation.

Actions that belongs to two or more sectors can be categorized as cross-cutting. In most cases, cross-cutting actions have benefits associated with both climate change mitigation and adaptation.

Criteria

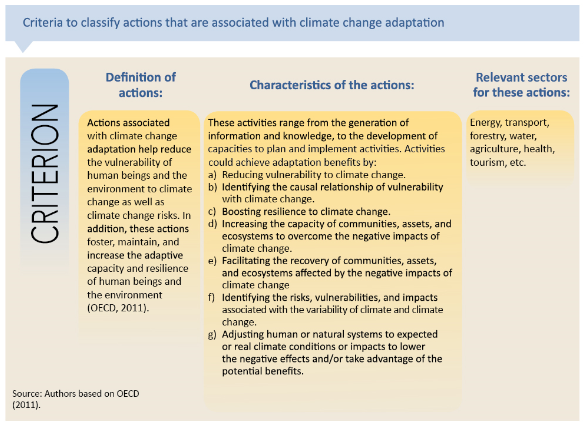

Funded activities are classified according to four criteria:

Criteria 1: Actions explicitly addressing climate change mitigation and/or adaptation.

Criteria 2: Actions associated with climate change mitigation, regardless of whether the explicit purpose of the action was to tackle climate change.

Criteria 3: Actions associated with climate change adaptation, regardless of whether the explicit purpose of the action was to tackle climate change.

Criteria 4: Actions that are associated with both climate change adaptation and mitigation, regardless of whether the explicit purpose of the action was to tackle climate change.

Criteria 2-4 aim to account for actions that, while not specifically adaptation or mitigation actions, have unintended climate change benefits. This distinction helps reduces the risk of overestimating climate finance.